Collectibles

Gold Coins and Gold Bullion

SHARE

Gold coins and gold bullion are two popular investment options for those looking to invest in gold. While both provide an opportunity to invest in the precious metal, they have their own unique characteristics and benefits.

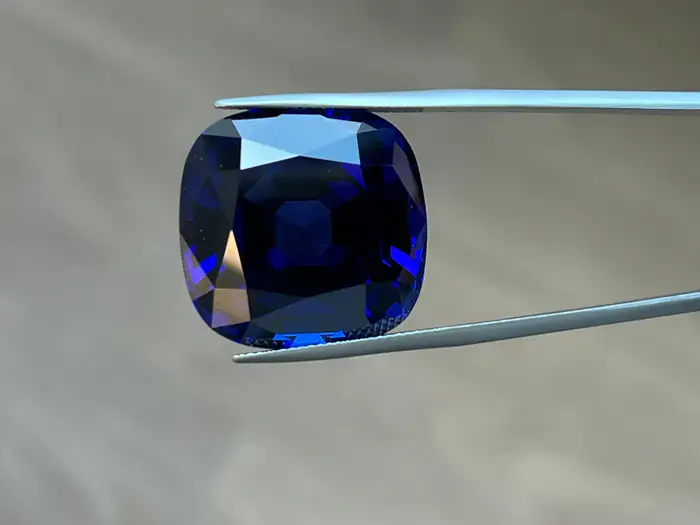

Gold coins are typically issued by government mints and have a legal tender value. They come in various sizes and designs, making them a popular choice for both collectors and investors. One advantage of gold coins is that they are easier to liquidate in smaller quantities than large gold bars.

On the other hand, gold bullion refers to gold bars or ingots that are typically sold in larger sizes, ranging from 1 gram to 1 kilogram or more. They are typically produced by private mints and do not have a legal tender value. Gold bullion is a popular choice for investors looking to buy larger quantities of gold at a lower premium over spot price.

Both gold coins and gold bullion have their own advantages and disadvantages when it comes to investing. Ultimately, the choice between the two depends on one’s personal preferences, investment goals, and budget.

While gold coins and bullion are often viewed as a stable investment, it is important to remember that the price of gold can fluctuate just like any other investment. It is important to do your own research and consult with a financial advisor before making any investment decisions.

Gold can provide diversification to a portfolio as it is a tangible asset that has historically performed well during times of economic uncertainty. In addition, it is not subject to the same inflationary pressures as other paper currencies.

In conclusion, gold coins and gold bullion are two viable investment options for those looking to invest in gold. Both have their own unique characteristics and provide an opportunity to diversify one’s portfolio. Ultimately, the choice between the two depends on individual preferences and investment goals.